4.9 Google Rating

Earn up to a $500 Federal Tax Credit with Purchase of Energy Efficient Systems

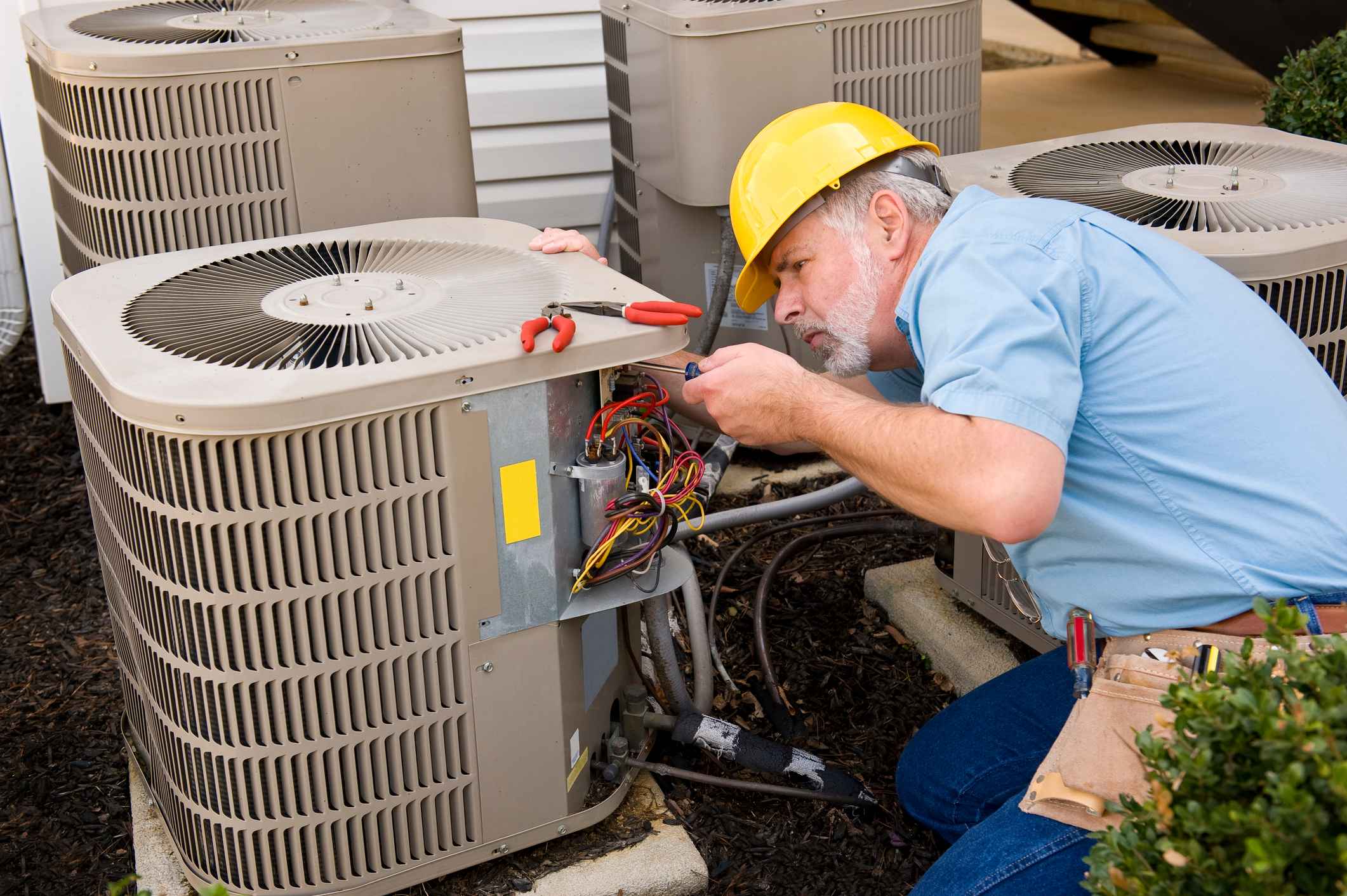

If you’re considering upgrading your HVAC system, now is the time to do it. With the ongoing emphasis on energy efficiency and environmental sustainability, the U.S. government is offering financial incentives to homeowners who install energy-efficient HVAC systems. One of the most attractive incentives is a federal tax credit of up to $500 for purchasing qualifying energy-efficient equipment. This not only helps you save on your energy bills but also reduces the upfront cost of upgrading your home’s comfort systems.

What’s the Difference Between a Tax Credit and a Tax Deduction?

Before diving into the details of how you can qualify for a tax credit, it’s important to understand the difference between a tax credit and a tax deduction.

A tax credit offers a dollar-for-dollar reduction in the amount of taxes you owe, directly reducing your tax bill. For example, if you qualify for a $500 tax credit, it will reduce the total taxes you owe by $500. Unlike deductions, which only lower the amount of your taxable income, credits directly cut the taxes you owe. Additionally, you don’t have to itemize your deductions to claim the tax credit, making it easier and more beneficial for many homeowners. This makes a tax credit a far better financial benefit than a tax deduction.

What Are the Requirements for the 2024 Federal Tax Credit?

The federal tax credit in 2024 is available for homeowners who install energy-efficient HVAC systems. These systems must meet specific requirements to qualify for the credit.

Eligible Equipment:

- Split AC Systems: The condenser and coil must be installed together to qualify.

- Heat Pump Systems: The condenser and air handler must be part of the installation.

- Furnaces or Blowers: A $50 additional credit is available for systems with a variable-speed or ECM motor.

- Insulation: You can claim 10% of the insulation cost, up to $500 (excluding labor costs).

Maximum Tax Credit:

- The federal tax credit is up to 10% of the cost of eligible HVAC equipment, with a cap of $500.

Efficiency Minimum Ratings:

- Split AC Systems: Must meet or exceed 16 SEER (Seasonal Energy Efficiency Ratio) and 13 EER (Energy Efficiency Ratio) ratings.

- Heat Pump Systems: Must meet or exceed 15 SEER, 12.5 EER, and 8.5 HSPF (Heating Seasonal Performance Factor).

- Package Units: These units have different efficiency requirements, so it’s essential to consult with your HVAC technician for specific details.

Most modern systems already meet these efficiency standards, especially those designed to reduce energy consumption and minimize your environmental impact. McCullough Heating & Air Conditioning offers a variety of HVAC systems that qualify for this federal tax credit, making it easier than ever to upgrade your home’s comfort while saving money.

How To Claim the Federal Tax Credit in 2024

Once you’ve installed your energy-efficient HVAC system, you’ll need to take the following steps to claim your tax credit:

- Complete IRS Form 5695: This form is used to calculate your residential energy credit.

- Keep Your Receipts: Maintain records of the installation costs and details of the equipment installed, including the SEER and EER ratings.

- Consult a Tax Professional: While the IRS website offers instructions, a tax professional can help you ensure you’re claiming the maximum tax credit available to you.

It’s also important to note that if you’ve claimed similar energy credits in previous years, you may need to check your past returns. Since this credit has been available intermittently, you may still be eligible even if you’ve taken advantage of it in the past. Consulting with your tax advisor can help clarify your eligibility.

Why Energy Efficiency Matters

Investing in energy-efficient HVAC systems is not only beneficial for receiving tax credits but also essential for reducing your monthly utility bills and environmental footprint. High-efficiency systems are designed to use less energy, which lowers your overall operating costs. For example, installing a high-efficiency heat pump or split AC system could cut your energy usage by as much as 20-30%. This translates to significant savings on heating and cooling bills throughout the year.

In addition to financial savings, energy-efficient systems contribute to environmental sustainability by reducing greenhouse gas emissions. The less energy your HVAC system consumes, the less strain it puts on the electrical grid, which is crucial as we move toward a more sustainable future.

Upgrade Your Insulation for Additional Savings

In addition to upgrading your HVAC system, consider improving your home’s insulation. A well-insulated home helps keep warm air inside during the winter and cool air inside during the summer, making your HVAC system more efficient. The federal tax credit allows you to claim up to 10% of the insulation costs, up to a maximum of $500.

Insulating your home can also improve overall comfort by reducing drafts and ensuring that your home stays at a consistent temperature throughout the year. By combining insulation improvements with a new energy-efficient HVAC system, you can maximize your tax savings and lower your energy bills.

How McCullough Heating & Air Conditioning Can Help

At McCullough Heating & Air Conditioning, we specialize in energy-efficient HVAC installations that help you save money and enhance your home’s comfort. Our team of expert technicians is well-versed in the latest federal tax credit requirements and can recommend systems that qualify for the 2024 incentive. Whether you’re in the market for a high-efficiency heat pump or a split AC system, we can guide you through the selection and installation process to ensure you’re getting the best possible value.

In addition to installing energy-efficient HVAC systems, we also offer a range of services to keep your system running smoothly, including regular maintenance and repairs. Whether you’re looking to improve your home’s energy efficiency or need assistance with an existing system, McCullough Heating & Air Conditioning has you covered.

Conclusion

If you’re ready to upgrade your home’s comfort while taking advantage of the federal tax credit in 2024, McCullough Heating & Air Conditioning is here to help. By installing a qualifying energy-efficient HVAC system, you can earn up to $500 in tax credits, reduce your energy bills, and contribute to a more sustainable future.

Contact McCullough Heating & Air Conditioning today to learn more about the tax credit and find out which systems are right for your home. Whether you need a new installation or regular maintenance, our team of HVAC experts is ready to assist with all your heating and cooling needs.

Recent News

BIG Changes to Federal HVAC Tax Credits: What Austin Homeowners Need to Know Before the End of 2025

Why Is My Heat Pump Not Turning On?

Local Matters

What Is a Ductless Mini Split?

Understanding the 2025 HVAC Refrigerant Mandate: What Austin Homeowners Need to Know

Why Spring 2025 Might Be the Smartest Time to Replace Your AC System